Hedge Fund

Market

The sharp fall in the oil price following OPEC's November 2014 meeting continued into 2015. The market expected further quantitative easing from the ECB in January, but Draghi surprised most market participants by launching an Asset Purchase Program that was larger than anticipated. The Euro weakened over the next 1,5 months, and parity with USD was hefty debated. The Euro reached its lowest level versus USD in March, and we did not see the Euro at those levels until ECB's December meeting, when the Euro strengthened 3% in a single day on the back of a less dovish ECB than expected.

The unexpected large stimuli program by the ECB and a rebound in the oil price lead to a significant improvement in market sentiment in the equity markets, the European in particular, and equity markets rose into April. The Chinese equity market continued to rally until June, when the bubble burst. While the Chinese saga played out in Asia, the situation in Greece accelerated in Europe. While creating a lot of headlines in the news and movement in Greek related securities and to a certain extent in European equities, the stress in the market was dwarfed by the surprise move by the Chinese central bank's announcement in August, stating that they intend to move towards a more market determined exchange rate. The liquidity in parts of the markets dried up, and we saw some extreme intraday moves. Even though the markets rebounded somewhat after the initial shock, the stress in the market was prevalent for the rest of the year.

After the initial fall in the oil price, oil rebounded and hovered around 60-70 USD until June, when it started to fall again. Rig counts fell less than expected, and global oil reserves continued to rise. In addition, the historical deal with Iran was signed July 15th, lifting international oil and financial sanctions. The weak development in commodity prices had a significant negative impact on credit markets. Due to the increased risk aversion in the market and technical selling pressure, spreads in the US high yield market widened by 200 bps in the second half of 2015. Spreads in the energy sector widened by 563 bps.

Looking beyond the western world and China, emerging markets, and commodity producing countries in particular, had a tough year. If you add political instability, lack of structural reforms and a country wide corruption scandal, you have Brazil. The Brazilian currency weakened 49% in 2015, and the 10 year inflation linked real rate hit 7.6% at peak.

In December, the US central bank finally raised the interest rate for the first time since the financial crisis. Being widely anticipated, the market impact was limited, but the USD strengthened 9.3% against a basket of world currencies in 2015.

The markets reacted much stronger to the disappointment following ECB's meeting in December. The year ended with a credit market in stress, an equity market having erased most of the gain from the start of the year, and with increased concern about China and commodity prices.

All four main HFRI hedge fund indices, Equity L/S, Event, Macro and Relative value, ended down for the year. The broad HFRI Composite index was down 1,1%.

Hedge fund portfolio

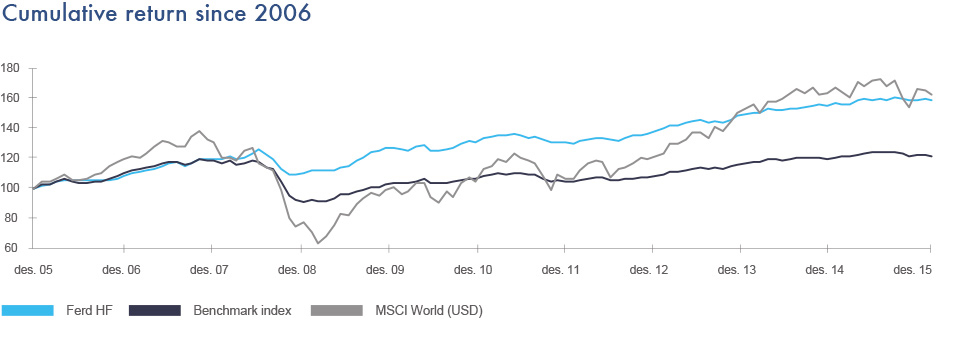

The hedge fund portfolio is denominated in USD and returned 1.9% in 2015, 1.4% ahead of the benchmark index. The portfolio is currency hedged to Norwegian Kroner internally against our treasury department, and the portfolio result in Norwegian kroner was 72 million. The market value of the portfolio as at the end of 2015 was 3,58 billion NOK.

We continued our effort to concentrate the portfolio in 2015. Turnover in the portfolio amounted to 17% as we redeemed in four funds and invested with two new funds. Based on initiated redemptions at year end, the number of funds will decrease to 17. The ten largest investments constitute 63% of the portfolio, and five of the portfolio's funds are closed to new investments.

The changes to the portfolio have not altered the portfolio's overall risk profile, as we have not wanted to increase the portfolio's market sensitivity. 58% of the portfolio is invested in relative value oriented funds, which returned 3.9% in 2015. Two of the funds in this group, a multi-strategy fund and equity market neutral fund, where the largest contributors to overall portfolio return, and also the highest returning funds in absolute terms. The allocation to macro funds was 14%, and returned 5%. Themes contributing to return were a constructive view on Europe, continued stimulus from the ECB, expectations of rate hikes in the US, and challenges arising from the weak development in commodity prices.

The three equity long/short funds returned 2.9% for the year. Positive contributions came from long positions in technology related companies, whereas the volatility in the Chinese equity market lead to a more challenging year for the portfolio's Asia focused equity manager.

The portfolio's event exposure posted a weak result, down 10%, and was driven by one fund. The two other funds only contributed marginally to the negative return, and their results were well within expectation in light of the development in underlying markets, and also outperformed peers.

Global Fund Opportunities

We have evaluated a considerable amount of investment cases during 2015. A majority of these cases involves investments in less liquid markets and instruments, and are hence structured in vehicles which require capital to be locked in.

We have made two investments totaling 60 MUSD. These funds are managed by managers we have known over several years. One of the funds targets investments in privately held companies who aim to go public in the near future (pre-IPO) and also invests in liquid stocks. The fund returned 15% in 2015. The second fund primarily focuses on purchases of debt and loans with asset backing in Asia from distressed sellers and banks exiting non-core markets. The investment pace of the fund is within expectations, but it is too early to make a meaningful assessment of investment results.

Organization

Entering 2015, Global Fund Opportunities was established as a new mandate in the business area. The mandate provides flexibility to invest in externally managed strategies which do not fit the hedge fund portfolio, but are deemed as attractive complements to Ferd's total investment portfolio and that provide risk diversification.

The team comprises two investment professionals and there have been no changes during 2015.

Outlook

We expect increasing uncertainty in the markets, and that the economic developments in China and the US as well as the oil price to be significant drivers of sentiment in the markets.

The new mandate provides us with a lot of flexibility in terms of pursuing attractive market opportunities that might arise from increased volatility, liquidity challenges and price action in the markets.