Invest

Markets

The markets behaved in 2015 very much as they did in 2014, but with even more pronounced trends. High-quality growth companies delivered the best returns, while investors shied away from commodities, oil and emerging markets. Copenhagen was again the best performing stock exchange in the Nordic region with a rise of 36%. Helsinki and Oslo were up 13% and 6% respectively, while Sweden was down 1%.

Return

The market value of Ferd Invest’s portfolio increased by 26.7% in 2015, which is 3.6% less than our benchmark index. Ferd Invest’s best investments in 2015 were Novo Nordisk, Axis Communications, SCA, Transmode, Autoliv and DSV. By far the worst investment was Opera Software, which alone reduced the portfolio’s performance by more than 7%. We increased our holdings in Opera Software throughout 2015, but in February 2016 we accepted a conditional offer for all the shares at a price which is some 40% over their closing price at the end of 2015. Apart from Opera Software, few companies in the portfolio caused significant underperformance, which is very pleasing.

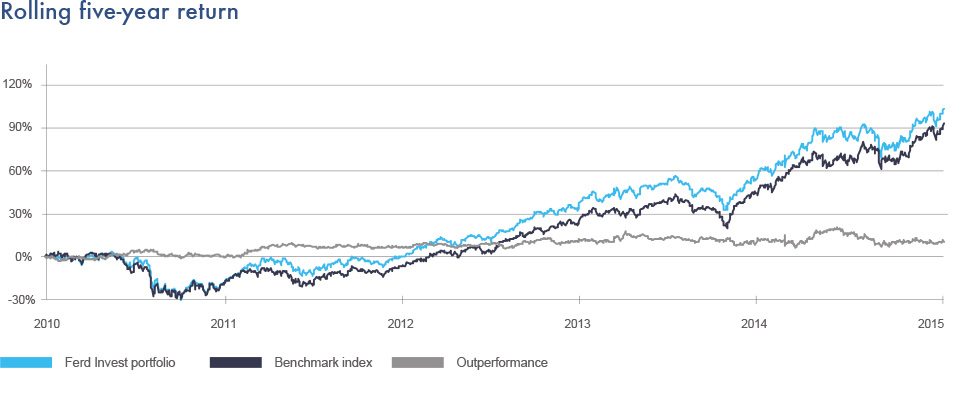

Ferd Invest’s long-term performance continues to measure up well. Over the last five years, the portfolio has achieved a return of 103%, during which time our benchmark index, the MSCI Nordic Mid Cap Index, has risen 92%.

Portfolio

The market value of Ferd Invest’s portfolio at the close of 2015 was NOK 6.3 billion. The portfolio’s investments are divided between the three Scandinavian stock markets, as well as the Finnish stock market. The largest investments at the close of 2015 were Novo Nordisk, Autoliv, ISS, Marine Harvest and Opera Software, and these investments represented slightly under 40% of the portfolio at year-end.

Organisation

The Ferd Invest team currently has three members. Alexander Miller resigned in May 2015, while Are Dragesund joined the team in November 2015. Samson Sørtveit and Lars Christian Tvedt are the other two members of the Ferd Invest team.

Future Prospects

2015 was a year in which clear trends from 2014 became even more pronounced.

The world’s investors seemed to agree that oil, commodities and emerging markets were best avoided, while the share prices of high-quality growth companies and companies with high dollar exposure were pushed up. At the same time, interest rates were even lower than in 2014, which further lowered the market’s required rate of return and provided growth companies with easy access to cheap capital.

We have, however, seen signs of a reversal in these clear and pronounced trends in the first quarter of 2016. Investors have in general become more unsure about whether companies can continue to deliver profitable growth, and companies with high valuation multiples that have so much as hinted that they might grow less strongly than previously predicted have seen their share prices severely punished. Equities were ripe for a correction after their long rise, and we think 2016 might be an exceptionally volatile year. However, low interest rates, the already low oil price and the generally healthy state of company balance sheets lead us to think that we are in no way heading for a crash of the same magnitude as seen in 2008, for example.